|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Banks That Refinance Homes in Foreclosure: A Comprehensive GuideRefinancing a home in foreclosure can be a daunting task, but there are banks willing to assist homeowners during this challenging time. In this guide, we will explore what refinancing options are available, how to qualify, and what to expect from the process. Understanding Foreclosure and RefinancingWhen a homeowner fails to make mortgage payments, the lender may initiate foreclosure proceedings. Refinancing in this context means securing a new loan with better terms to pay off the existing mortgage and prevent the foreclosure from being finalized. Why Consider Refinancing?

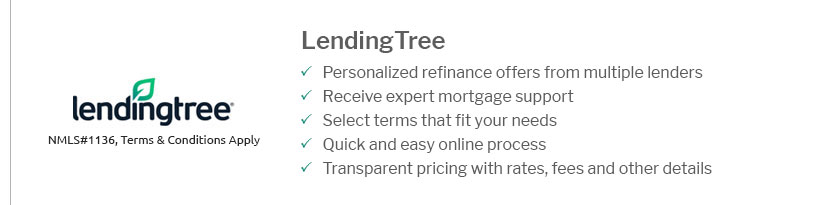

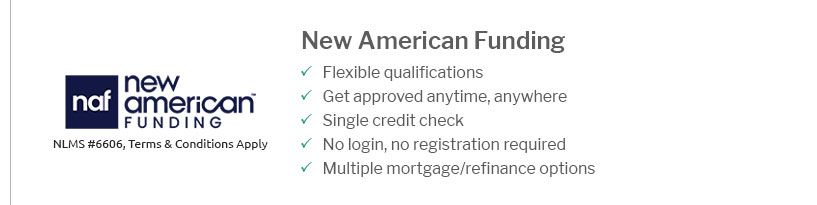

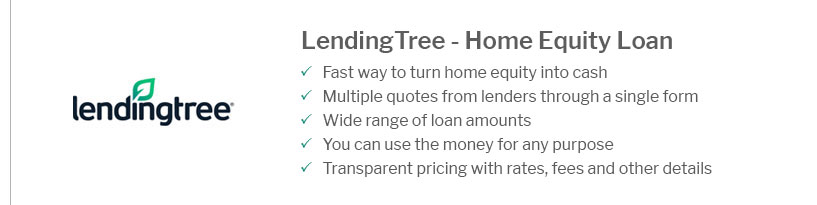

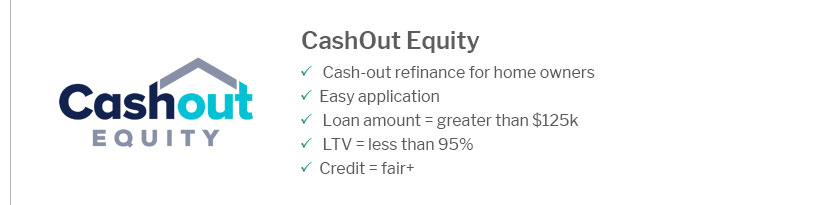

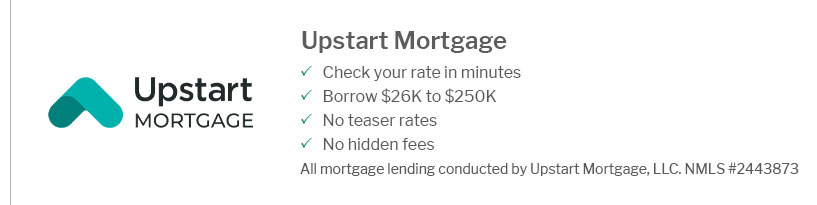

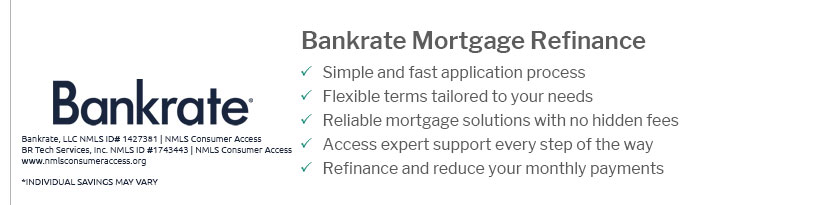

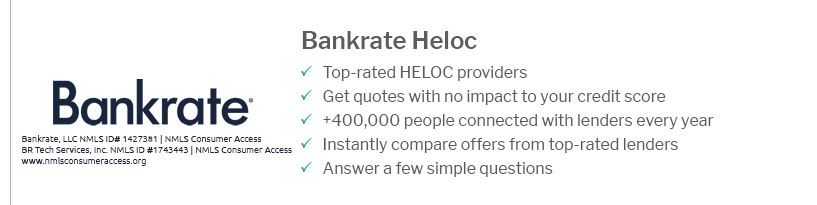

Banks That Offer Refinancing for Homes in ForeclosureSeveral banks specialize in refinancing options for homes in foreclosure. It's crucial to research and compare their offers to find the best fit for your needs. What to Look For

Steps to Refinance a Home in ForeclosureRefinancing a home in foreclosure involves several critical steps. Being prepared and understanding each phase can improve your chances of success. Gather Necessary DocumentsEnsure you have all necessary documents, such as proof of income, tax returns, and bank statements, to streamline the application process. Shop Around for LendersCompare different lenders and consider options like a no fee cash out refinance to tap into your home's equity without incurring additional costs. Understand the TermsBefore signing, thoroughly understand the loan terms and conditions. Ask questions if any part of the agreement is unclear. FAQs About Refinancing Homes in ForeclosureCan you refinance a home in foreclosure?Yes, it is possible to refinance a home in foreclosure, but it often requires meeting specific eligibility criteria set by lenders. What are the benefits of refinancing a home in foreclosure?Refinancing can lower your monthly payments, stop foreclosure proceedings, and allow you to remain in your home. Are there any risks involved in refinancing during foreclosure?While refinancing can be beneficial, there are risks such as potentially higher interest rates and fees if not carefully negotiated. https://better.com/faq/loan-types-and-products/do-you-offer-loans-for-the-purchase-of-foreclosure-or-bank-owned-properties

Yes, we do offer mortgages for the purchase of foreclosed and/or bank-owned properties. However, any required repairs must be completed in a timely manner. https://www.strattonequities.com/foreclosure-bailout-loans

Stratton Equities is a nationwide direct private money lender and has a foreclosure bailout mortgage option to help stop foreclosure regardless of your credit ... https://foreclosures.bankofamerica.com/louisiana

With the Bank of America Digital Mortgage Experience you can prequalify or refinance online.

|

|---|